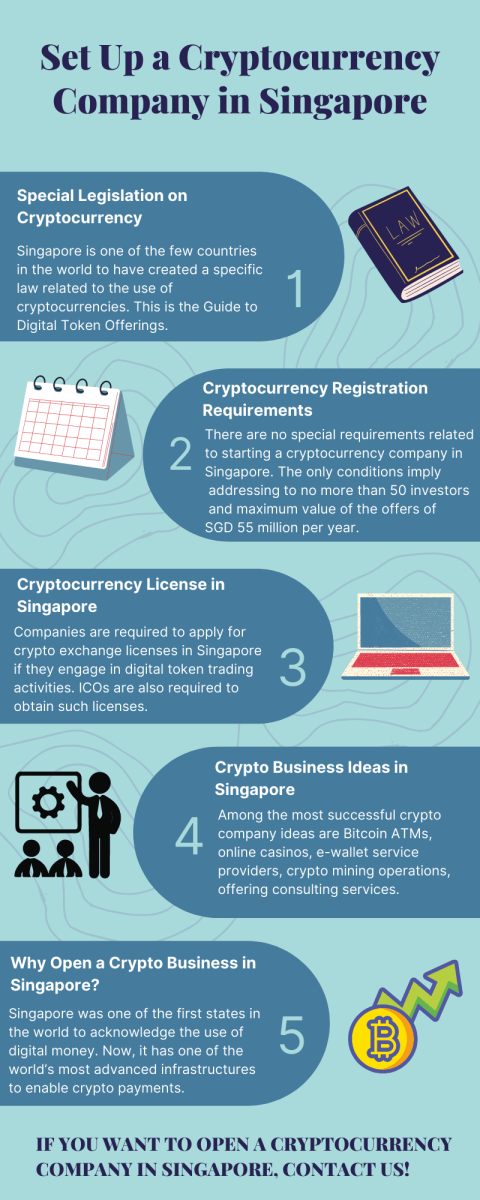

Singapore does have in place a crypto licensing procedure, however not all who want to open cryptocurrency companies in Singapore are required to apply for this license, as there is other criteria as well. Our Singapore company formation specialists can explain the requirements related to establishing a cryptocurrency company in the city-state and details on how to obtain a crypto license in Singapore.

Singapore has secured its position among the preferred fintech destinations for foreign investors all over the world thanks to the favorable taxation system and the modern regulatory framework which covers a wide range of activities connected to the financial industry. One of the newest and most sought types of businesses to be set up in the fintech sector is related to the cryptocurrency field in Singapore.

| Quick Facts | |

|---|---|

| Special legislation available (YES/NO) |

YES, the Guide to Digital Token Offerings, the Guidelines on the Regulation of Markets, the Futures and Securities Law |

| Regulatory authority | Monetary Authority of Singapore (MAS) |

|

Types of entites used to register the company |

Most type of companies can be used, however the LLC is preferred to open a cryptocurrency company in Singapore |

| Local manager required (YES/NO) |

YES |

| Minimum capital requisites (YES/NO) | NO |

| License required (YES/NO) | YES, cryptocurrency exchange license must be obtained as per certain criteria |

| Licensing exceptions (YES/NO) |

YES, companies that do no trade digital coins are not required to obtain a license |

| Timeframe to register the company (approx.) |

It takes approximately one week to open a cryptocurrency company in Singapore |

| Anti-money laundering regulations applicable (YES/NO) | YES, all crypto companies must respect such regulations |

| Specific requirements for foreign investors (YES/NO) | NO |

| Activities permitted for crypto companies | ATM setup, crypto mining, e-wallet creation, etc. |

| Other special requirements applicable (YES/NO) | YES, cryptocurrency companies must create offers for a minimum number of 50 investors per year; the offer cannot exceed SGD 55 million for the respective year |

| Taxation of cyrpto companies in Singapore | Corporate tax of 17% must be paid by cryptocurrency companies in Singapore |

| Why choose Singapore | Regulated sector, the existence of the Cryptocurrency and Blockchain Industry Association for small companies, low corporate tax with the possibility of obtaining various tax reductions |

| Support in launching a cryptocurrency business (YES/NO) | YES, we can help you open a cryptocurrency company in Singapore |

The cryptocurrency environment in Singapore

The Monetary Authority of Singapore (MAS) is the main regulator of the financial field in the city-state and it also provides for the creation of cryptocurrency businesses. 2017 was an important year for the Singapore cryptocurrency sector as the MAS has begun considering enabling legislation which regulates the issuance and the use of virtual coins. MAS has also recently created a legal framework for those interested in setting up cryptocurrency funds for the coin offerings (ICOs).

Foreign investors should also know that Singapore is among the few countries in the world to have a Cryptocurrency and Blockchain Industry Association dedicated to small and medium-sized enterprises (SMEs) operating in this field.

Our company formation experts in Singapore can assist foreign investors who want to start cryptocurrency companies here.

Our local consultants can explain the various advantages of setting up a company in Singapore and can also assist overseas investors who are interested in employing various business entities for their economic operations in the city-state. Feel free to address our specialists for details on the conditions you need to respect to run a company here.

Dubai is also considered a favorite crypto destination and if you are interested in opening a company there we can put you in touch with our local partners who can also help you obtain a trade license in UAE.

Regulations imposed on cryptocurrency companies in Singapore

An investor who plans to open a company in Singapore in the cryptocurrency sector should know that he or she will be subject to the regulations recently enabled by the Monetary Authority. Among these regulations we mention the following:

- – the Guide to Digital Token Offerings which was created in 2017 by the MAS;

- – the Guidelines on the Regulation of Markets which now address to cryptocurrency trading;

- – the Anti-money Laundering Regulations which is one of the most important laws applicable in this field;

- – the Futures and Securities Act under which virtual money is treated as a commodity for trading purposes.

You can ask our Singapore company formation specialists about the regulations imposed when setting up a cryptocurrency business. It is important to notice, that cryptocurrency exchanges must now obtain a crypto exchange license with the MAS before starting the trading activities.

Forms of digital tokens in Singapore

If you want to open a Singapore company and trade or complete other activities related to cryptocurrencies, it is useful to know that digital tokens can take one of the following forms:

- – that of financial assets;

- – that of payment tokens;

- – that of utility tokens.

This is an important aspect, as not all of them require a cryptocurrency exchange license in Singapore. Those regarded as financial assets that can be traded are subject to stricter regulations.

Requirements to obtain a cryptocurrency exchange license in Singapore

Exchange companies are among the most profitable businesses in Singapore and those trading cryptocurrencies have gained popularity as the use of digital money has increased. In light of these developments, obtaining cryptocurrency exchange licenses has become a requirement in the city-state.

Here are the main aspects to consider when setting up a company in Singapore with the purpose of trading virtual money:

- it must set up a system for limiting risks related to the cryptocurrency exchange;

- it must adhere to the laws of transparent and legal trading;

- it must ensure it has sufficient financial, technological and employees to carry out its activities;

- it is required to safeguard the platform’s financial assets and the privacy of consumer data;

- it must ensure the recording of each transaction;

- it must create a board of directors and committees for payments, audits, and resolution of conflicts.

Apart from these, the cryptocurrency company must also comply with the Anti-Money Laundering laws, and must set in place Know-Your-Client (KYC) regulations.

These are general rules that apply in countries all over the world, however, it is worth noting that Singapore was among the first to introduce them.

We also invite you to watch our video on how to open a company in Singapore as a cryptocurrency business:

Requirements to comply with after setting up a company in Singapore for crypto operations

Once the creation of the cryptocurrency company is completed and the license has been obtained, it is important to make sure that:

- – the business has its own internal policies for operating cryptocurrencies;

- – it has the capability of assessing the risks associated with its operations, as well as the measures to reduce them;

- – it appoints or hires persons that are authorized to operate under the MAS’ regulations;

- – it monitors the operations and record all transactions completed on its platform (records of the transactions must also be kept);

- – it keeps information on its clients, as well as it identifies suspicious transactions and reports them to the relevant authorities;

- – it completes regular reports with the MAS;

- – it offers continuous training to its employees.

Our Singapore company formation agents can offer more information on the regulations you need to comply after obtaining a cryptocurrency exchange license. We can also assist those who want to operate in this filed without needing such a license.

Business ideas in the Singapore cryptocurrency field

We mentioned earlier the possibility of establishing cryptocurrency exchanges, however, a business person who wants to open a company in Singapore as a crypto business have various options. Among these, the most popular are:

- – cryptocurrency ATMs which are machines through which money can be exchanged into virtual money;

- – cryptocurrency mining businesses are also very popular in Singapore as they benefit from a high degree of flexibility;

- – one can also set up a casino which accepts payments in cryptocurrencies;

- – e-wallets have become very popular in Singapore since the crypto exchange license has been introduced;

- – IT companies which operate in the field of cryptocurrencies can also be set up in Singapore;

- – one can also offer consulting services related to investing in cryptocurrencies.

While for some of these business ideas there is no need for a license, there are others which are subject to certain licensing criteria. The most important aspect to consider is that all cryptocurrency companies in Singapore must comply with the anti-money laundering regulations.

Cryptocurrency companies registered in other countries can expand their operations by setting up a subsidiary in Singapore.

Company formation requirements for a cryptocurrency business in Singapore

Those who want to open a company in Singapore in the cryptocurrency sector must first register one of the types of structures acknowledged by the Commercial Law. Following that, a special license will be required for financial companies interested in exploring the cryptocurrency field. IT companies can also issue cryptocurrency without applying for any special permits with the MAS.

All types of companies must comply with the anti-money laundering regulations imposed by the MAS in order to protect the clients and investors in the case of cryptocurrency funds.

Licensing requirements for cryptocurrency companies in Singapore

The most common type of cryptocurrency company which requires a license to operate in Singapore is the cryptocurrency exchange. This type of company is usually treated as a trading platform and is required to obtain a crypto exchange license from the MAS. The good news is that Singapore already has a few crypto trading platforms.

The MAS imposes a few conditions for those interested in setting up a company in Singapore in the crypto field and intend to trade virtual money on the Singapore market. Among these are:

- – the company must be registered in Singapore in order to obtain such a license;

- – the company must prepare a prospectus which must contain information about the token to be traded;

- – the company must create an offer which does not address more than 50 private investors in a period of a year;

- – the maximum value of the offer is currently set at 55 million SGD for one year.

Apart from these, the MAS will also consider specific conditions which must be met the company applying for the crypto exchange license. The offer will usually take the form of an initial coin offering, shortly known as ICO. Our local advisors can offer more information about the creation and launch of an ICO in Singapore. With a vast experience in company formation matters, our consultants can help you open a company and obtain a crypto license in Singapore.

Legislation governing the crypto exchange licensing requisites in Singapore

All companies applying for a cryptocurrency exchange license in Singapore must comply with the Anti-Money Laundering Act and the Futures Act which provide for the transparency conditions related to trading virtual tokens, respectively the conditions imposed for a digital coin to be considered security which can be traded.

Singapore cryptocurrency companies must also ensure the minimum management conditions imposed by the MAS.

For full information on the conditions related to obtaining a crypto license in Singapore, you can rely on our team. We remind investors that we can help them open a company in Singapore.

The most traded cryptocurrencies in Singapore

Singapore is one of the most open countries in Southeast Asia when it comes to setting up cryptocurrency companies. One of the main reasons is that it allows for various virtual tokens to be trader here. Among these Bitcoin, Litecoin and Ethereum are the most traded ones. However, it is also possible for those operating cryptocurrency businesses here to trade less popular digital tokens such as Ripple, EOS, NEO and Dash.

We are also at your service if you want to open a subsidiary in Singapore.

Taxation of crypto activities in Singapore

Cryptocurrencies have been legal in the city-state for many years now, however, as they not used as much, they were not subject to strict taxation requirements. However, once the industry has developed, crypto companies in Singapore must now pay the income tax which is levied at a flat rate of 17%.

Singapore also offers various benefits from a taxation point of view, and one of the most important is that there is no capital gains tax or sales tax levied on this type of income. When it comes to the GST, such services are usually levied at a 7%, however, the use of virtual coins for payment is exempt from it.

We are at your disposal with various accounting services, including updated information on all the changes that occur in this field.

Why register a cryptocurrency company in Singapore?

Singapore is at the forefront of countries accepting cryptocurrency payments and the legislation in this sense allows for the opening of various types of fintech businesses which deal with the promotion of various types of virtual money. Also, setting up a company in Singapore in the cryptocurrency sector is cheaper than other known destinations, such as Liechtenstein or Switzerland in Europe.

Starting a Singapore cryptocurrency business also has various tax advantages, among which a corporate tax rate which applies progressively, and which implies a partial exemption from payment for specific amounts of profits. Also, virtual money treated as commodities and sold to non-residents will not be subject to VAT payments in Singapore. When adding that to the fact that cryptocurrency companies can be set up as startups, Singapore becomes a great country for this type of business.

If you want to open a cryptocurrency company in Singapore and need assistance, do not hesitate to contact our specialists in company formation in Singapore. You can rely on us if you want to obtain a crypto license in Singapore or open any type of company in the city-state.