The Pte Ltd or the private limited company is among the most popular business forms in Singapore. It is a type of legal entity that can have a limited number of shareholders, and its shares are not available to the public. However, it has a set of clear advantages to investors and it is subject to a simple incorporation procedure.

We present essential information about the Pte Ltd in Singapore requirements for investors and details about the post-registration phase. For more comprehensive information, we invite investors to contact our experts in the registration of a private limited company in Singapore.

| Quick Facts | |

|---|---|

| Applicable legislation |

The PTE LTD falls under the Singapore Company Act |

|

Minimum number of shareholders

|

A Singapore private limited liability company requires at least one shareholder |

|

Minimum number |

One director is required to create a PTE LTD in Singapore |

| Resident director required (YES/NO) |

YES, at least one resident director is required for a PTE LTD. |

| Company secretary required (YES/NO) | YES, a PTE LTD must also have a company secretary |

| Singapore legal address required (YES/NO) |

YES, such a business form must have a local legal address |

| Minimum share capital |

The minimum share capital for a PTE LTD in |

| Local bank account required (YES/NO) | YES, local bank creation is required for such a business |

| Best Used for |

The private limited liability company can be used for all types of activities, including trading and e-commerce, as well as a startup |

| Remote registration possibility (YES/NO) | YES, setting up a company in Singapore as a PTE LTD remotely is possible with the help of a local agent |

| Approx. timeframe for incorporation | Approx. 5 business days |

| Corporate tax applicable | The PTE LTD must pay the standard corporate tax of 17% or even 0 |

| Accounting requirements | PTE LTDs must file annual accounts with ACRA |

| Advantages of a Singapore PTE LTD | Easy and quick registration, access to tax incentives and government grants, full foreign ownership is available, corporate tax exemptions are also available |

| Incorporation services availability (YES/NO) | YES, we offer company formation support in Singapore |

What are the main features of the Pte Ltd Singapore?

The private limited company, or Pte Ltd, is a business form that has many advantages, therefore it is widely used by investors who are interested in starting a small or medium-sized business. In order to register a private limited company in Singapore, investors need to follow a few simple rules regarding the minimum number of founders as well as the requirements for registration and obtaining additional permits for functioning.

Our Singapore incorporation experts detail the Pte Ltd requirements in 2024 further in this article. However, it is useful to remember that this business form requires one of the following elements: one shareholder, one director, one secretary, 1 SGD capital as well as one registered address in Singapore. We detail these requirements below and our agents are able to answer any other questions that investors may have on how to open a Singapore company as a Pte Ltd and are not covered in this article. We can also help you if you need to open a company in another country, such as Cayman Islands.

What are the requirements for shareholders and directors in Singapore?

Company shareholders and directors in Singapore must be at least 18 years of age. The company has a minimum of one shareholder who can be a natural or legal person and at least one director. A company secretary is also required, who is a local resident in Singapore (this position needs to be filled within 6 months). The sole director cannot act as a company secretary.

The company director needs to have full legal capacity and be a Singapore citizen, permanent resident or hold an EntrePass (a type of permit that allows entrepreneurs to start and operate a new business, provided that they meet the eligibility criteria). A foreign company director can also occupy this position if he holds an Employment Pass, however, a special letter of consent from the Ministry of Manpower is required in this case.

The company director has a number of duties for the good functioning of the company. Among these, we can mention the fiduciary duty, according to which the director acts in the best interest of the company as well as the duty of diligence that refers to the care and skill used to manage the business.

The requirements for the Pte Ltd in Singapore are only briefly discussed in this guide. If you are interested in setting up a company in Singapore as a Pte Ltd you can reach out to one of our agents for complete details.

What are the requirements for the minimum share capital for the Pte Ltd in 2024?

You can actually can start a Pte Ltd with one 1 SGD. The conditions for the minimum share capital do change however if the company is a regulated business, such as a financial services agency or a recruitment agency or even a travel agency. In these cases, the minimum paid-up requirements will change. Another situation in which the minimum capital has a minimum value of 50,000 SGD is when the investor is also applying for a relocation visa, the Entrepreneur Pass.

One of our agents who specializes in setting up a private limited liability in Singapore can give you complete details on these requirements.

What are the incorporation requirements for a Pte Ltd Singapore?

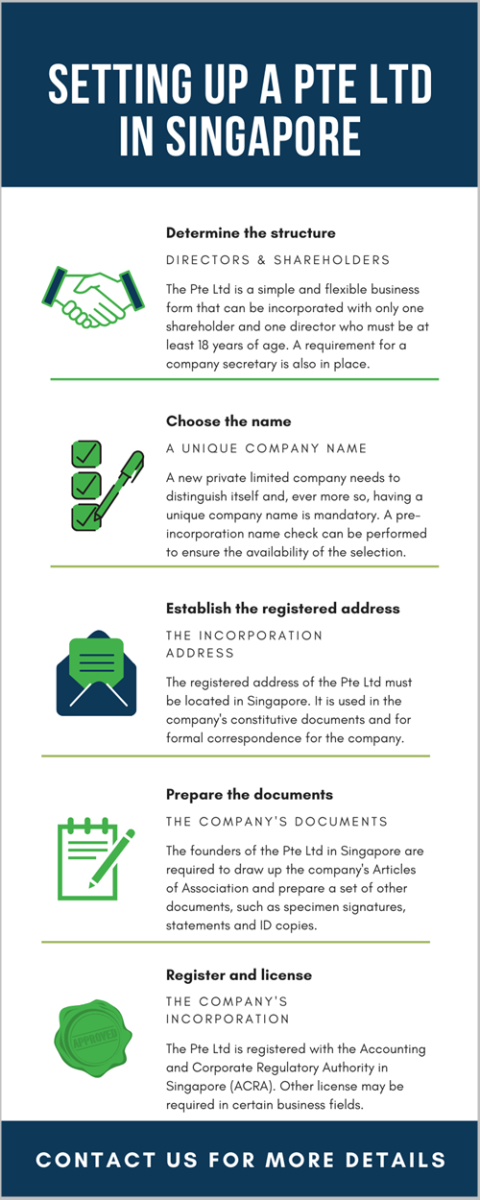

The investor will need to prepare a set of documents and make several decisions as to the structure of the company. Some of the document requirements and decisions are listed below:

- Company name: the Pte Ltd Singapore needs to have a unique name, one that does not infringe on any existing ones.

- Registered address: this is the address included in the company’s constitutive documents that need to be located in Singapore; this is where the company’s communications and notices are sent to and where the register and records are stored.

- Business activities: the company needs to select a business activity or activities that will be included in the company documents.

- The shareholding structure: this company can be incorporated with only one shareholder, however, when this is not the case, the shareholding structure is to be properly defined.

- Articles of Association: these are the company’s constitutive documents, the ones that outline the scope of the business, the activities, the names of the shareholders and directors, the address of the registered office, and others.

Choosing an available company name, preparing the Articles of Association, and filing the registration form is essential when setting up a private limited company in Singapore. The name of the company needs to be unique, thus the first step for company registration is to reserve the chosen name. The registration process cannot advance unless the company has its name approved. The registered office needs to be accessible to the public during normal office hours, however, it does not need to be the sole place where the company conducts part or all of its activities.

The registration of a private limited company in Singapore is a simple process and one that starts with checking and reserving the company name. Our agents can help investors go through all of these mandatory steps as well as draw up the required documents. It is advisable to also draw up a shareholder’s agreement in those situations in which the company has more shareholders. This agreement can be a useful instrument in cases that involve different types of shareholder disputes. As a particularity of company registration in Singapore, investors should note that the names of the company shareholders and directors are disclosed when registering the business.

There are two types of shares that can be used when setting up a private limited company in Singapore in 2024: ordinary shares (with voting rights and certain rates of remuneration as per the rates of the dividends) and preference shares (that can offer preferential rights over ordinary ones, most notably in terms of dividend distribution).

A company, once incorporated, is assigned a unique entity number. This is the UEN and it is used when engaging in transactions with government agencies.

Companies that have a paid-up capital of more than 0.5 million SGD are automatically introduced as members of the Singapore Business Federation.

We invite investors to watch the following video on the Pte Ltd:

Features of Singapore exempt private companies

Apart from the fact that an exempt private company must have a maximum number of 20 shareholders, they must be natural persons, as no companies are allowed to own shares in this type of entity. The Singapore exempt private company must also have at least one resident director, a secretary, and a registered address in the city-state.

The name of exempt private company comes from the fact that this type of business is not required to submit audited accounts if its yearly turnover is less than 5 million SGD. It is only required to file a solvency declaration.

Open a company in Singapore as an exempt private company

The registration procedure for a Singapore-exempt private company is the same as for any other type of structure. The following steps must be followed:

- selecting a company name;

- preparing the incorporation documents;

- submitting the incorporation documents together with an application form with the Accounting and Corporate Regulatory Authority;

- filing for any additional or special licenses.

Once these steps have been completed and the company has received its Certificate of Incorporation, it must register for taxation. One must also pay attention to the fact that company registration is done through a local representative.

What are the taxation and accounting compliance principles for the Pte Ltd Singapore?

Singapore is a preferred location for company formation because of the low tax regime. The Pte Ltd Singapore is subject to a corporate income tax rate of 17%. New companies can also qualify for an exemption where the first 100,000 SGD of the normal chargeable income and 50% of the next 200,000 SGD of chargeable income are exempt from tax, for the first three consecutive years of assessment.

The tax year is usually the same as the calendar year and companies must submit the estimated chargeable income with the IRAS. As far as accounting is concerned, any relevant documents are to be kept for at least three years after the completion of the transaction.

One of our agents who specializes in setting up companies in Singapore can provide you with more details on taxation, other than the ones highlighted in this guide on setting up a Pte Ltd in Singapore.

Companies are required to appoint an auditor within three months after they have been incorporated. However, certain types of companies may be exempted from this requirement when they are treated as a small company, as per the Companies Act. A company is a small one, and therefore exempted from appointing an auditor, when it is a private company for the financial year in question and when it meets at least two of the following three criteria: has a total revenue of less than 10 million SGD, is has total assets with a value of less than 10 million SGD and has fewer than 50 employees.

The Companies Act also provides for several other requirements that need to be fulfilled by the company director. These include the following:

- Hold the general annual meeting, unless the company is exempt from this;

- File the annual return within seven months after the closing of the financial year;

- Maintain the register of registrable controllers: the information on the beneficial ownership of the company that may be available to the public upon request;

- Maintain the electronic register of members: this is a list of all shareholders that needs to be updated as any changes in ownership take place.

- Maintain other registers, such as those for the secretaries, auditors and chief executive officers;

- Notify of any change in the company information within 14 days of their occurrence (these can refer to the company’s name, activity or address).

Our team of agents can guide you on setting up a Pte Ltd in Singapore in 2024 and can give you more details on each of the steps for opening this type of company as well as the general requirements for management and reporting.

Company licensing in Singapore

Certain companies incorporated under the Pte Ltd require special permits or licenses in order to legally engage in business activities. A number of agencies in Singapore govern the manner in which activities in a certain business field may take place. For example, cafes are licensed by the National Environmental Agency while the Agri-Food Veterinary Authority licenses businesses such as pet shops. Trade companies will need to apply for a special permit from the Singapore Customs. Other common examples of licenses include those for food shops, liquor stores (with a separate one for shops with extended operating hours), for tobacco retailers, petroleum or flammable materials storage or public entertainment.

When requesting a license for these regulated business sectors, the applicant must have a certain position within the company (managing director, director, secretary or chief executive officer). Licenses are subject to certain fees and in some cases, payment is done in two separate stages (one upon submission and one upon approval).

It is advisable to determine whether a business requires additional licensing before commencing the registration procedure with ACRA. One of our agents can help you with more information on licensing a Singapore limited company.

Post-Incorporation Details for a Pte Ltd in Singapore

Once the company is registered and licensed, investors will need to hire employees. This is an important step and an action that is governed by the Employment Act, the legislative document that contains information on working conditions. Foreign talent is welcomed and in demand and the policies for hiring overseas workers are simplified ones, starting with making the necessary applications with the Ministry of Manpower, the Work Pass Division.

Hiring foreign employees may be a lengthier process in some cases as the Ministry evaluates the applications and issues a reply within approximately three weeks. In some cases, the approval for hiring a foreign national may only be obtained once the employer has shown that there were no options for finding a qualified individual for the position among the local pool of workers. This recruitment process, along with the tax compliance for reporting employee earnings and others should also be taken into consideration during the early stages of company formation.

Pte Ltd formation for Entre Pass holders

Foreign investors looking to open a Pte ltd in Singapore can qualify for an Entrepreneur Pass, or the EntrePass, Scheme. This is designed to attract talent into the country and further improve Singapore’s position as a regional business hub.

Below, our team of Singapore limited company specialists describes this scheme and why investors might want to consider it if they are looking to start a private limited company.

The main eligibility conditions for the EntrePass are the following:

- be at least 21 years of age and have relevant qualifications and experience in the field of interest;

- propose an innovative business that will also be able to allow for local job creation;

- relocate to Singapore to run the new business;

- open a Pte Ltd in Singapore (this has to be the chosen business form);

- alternatively, if the company is not incorporated once you arrive, you can apply for the scheme with a company that has been incorporated for no more than six months at the time of the application;

- hold at least 30% of the shares in the business.

Apart from these general criteria, foreign investors who apply for the EntrePass must qualify for one of the three categories:

- Entrepreneur: the company receives funding or investment of at least 100,000 SGD from a third party that is accredited by a Singapore government agency. Moreover, the company is formed in a business incubator or accelerator that is recognized by the Singapore authorities. The applicant must have an established business network and a history as an entrepreneur.

- Innovator: the applicant has collaborated with a Singapore Institute of higher learning or another eligible research institute. He has a record of significant achievements in his area of expertise, he possesses intellectual property.

- Investor: he has a history of significant investments.

Applicants should know that the EntrePass is not available for any type of business. Examples that are not accepted include coffee shops, food courts, bars, nightclubs, massage parlors, traditional Chinese medicine businesses, acupuncture businesses or employment agencies, among others.

The applicant needs to provide relevant documents when he submits the application for this scheme. These include the application form, proof that the individual complies with the eligibility criteria, copies of his identity documents (passport), a business plan drawn up in a standard format (our agents can provide you with the model) as well as others.

Choosing the right business structure in Singapore

The Pte Ltd is not the only type of business entity that can be incorporated in Singapore. Below, we briefly list some other options.

Sole proprietorship – this is the simplest business form in Singapore and also the one that has the highest level of liability for the investor. It is not a separate legal entity, it can be sued in the owner’s name and the entrepreneur is personally liable with his assets for the losses of the business. Foreign investors cannot open a sole proprietorship as easily as a Pte Ltd; they need to appoint a local resident as the authorized representative.

Partnership – This can be general or limited, referring to the level of liability that applies to the founders; this business form shares the characteristic of unlimited liability with the sole trader and although for the limited form only one of the partners is fully liable, it does not remain a more attractive business form than the Pte Ltd. The limited liability partnership can be an option for investors who carry out a certain profession (lawyers, accountants, etc.).

As seen in the list presented above, the Pte Ltd in Singapore is one of the most advantageous business forms for foreign investors because it allows for full foreign ownership along with protection from business liability. However, Singapore citizens, permanent residents, or EntrePass Holders can opt for the sole trader in the event that the business is a small one and the product/services do not involve liability issues. likewise, a partnership can be a suitable option when the manner in which the entrepreneur will work will be under a joint practice with other professionals. In all other cases, the private limited liability in Singapore remains the most suitable option for long-term business.

Choosing the right business structure is the first step to investing in Singapore. Understanding the requirements that apply to each type, along with the characteristics, is essential for entrepreneurs.

Doing Business in Singapore – a few facts

Many foreign investors seek a personalized guide on setting up a Pte Ltd in Singapore when they decide to incorporate in the city-state.

Manufacturing is by far the largest industry in Singapore, accounting for 20–25 percent of the GDP each year. The foundation of Singapore’s manufacturing industry is the production of electronics, which accounts for 20% of all manufacturing jobs and 8% of the country’s GDP. Apart from this, the following sectors are top industries:

- pharmaceutical and biological – Singapore produces 60% of the micro-arrays used worldwide;

- Singapore produces 4 of the 10 pharmaceuticals with the highest worldwide revenue;

- energy- Singapore ranks 5th globally in terms of refined oil exports;

- chemical – Singapore is among the top 10 exporters of chemicals worldwide.

The data mentioned in this article is issued by the Department of Statistics Singapore.

Apart from the developed industries and the easy set up for a private limited company in Singapore, investors can also benefit from a number of tax incentives. These include the following:

- Exemption of income for venture companies or for international shipping profits;

- Exemption of income of shipping investment enterprise;

- Deductions for expenditure on research and development projects and for expenses related to trade fairs, exhibitions, trade missions of the maintenance of an overseas trade office;

- an exemption and concessionary rate of tax for insurance and reinsurance businesses;

- concessionary tax for a financial sector incentive company or for a global trading company;

- development and expansion incentive as well as investment allowances.

Please keep in mind that this is only a short summary of the tax incentives that are available in Singapore and are governed by the Singapore Income Tax Act as well as the Economic Expansion Incentives Act. We recommend getting in touch with our agents for more information on how a private limited company can access these.

Local and foreign investors may find that the Pte Ltd is a suitable business entity choice for investing in any of these mentioned sectors, provided that the company will have a small or medium-size and that it will not be listed on the stock exchange. When needed, a private limited liability company can be converted into a public limited liability company with the help of our experts.

Contact us if you have any further questions or if you need complete specialized assistance for setting up a private limited company in Singapore in 2024.